how to calculate stamp duty malaysia

For example you want to rent out your unit at RM1200 per month. Stamp duty -A stamp duty fee of RM10 is charged before the final payment amount is calculated.

Current Stamp Duty Calculation Hhq Law Firm In Kl Malaysia

The Malaysia Inland Revenue Authority also known as Lembaga Hasil Dalam Negeri Malaysia LHDN Malaysia is where you pay your.

. There is no stamp duty Tax applied to the first 250000. Calculating the stamp duty amount for your tenancy agreement isnt that hard. Do I need to pay stamp duty on non-residential property.

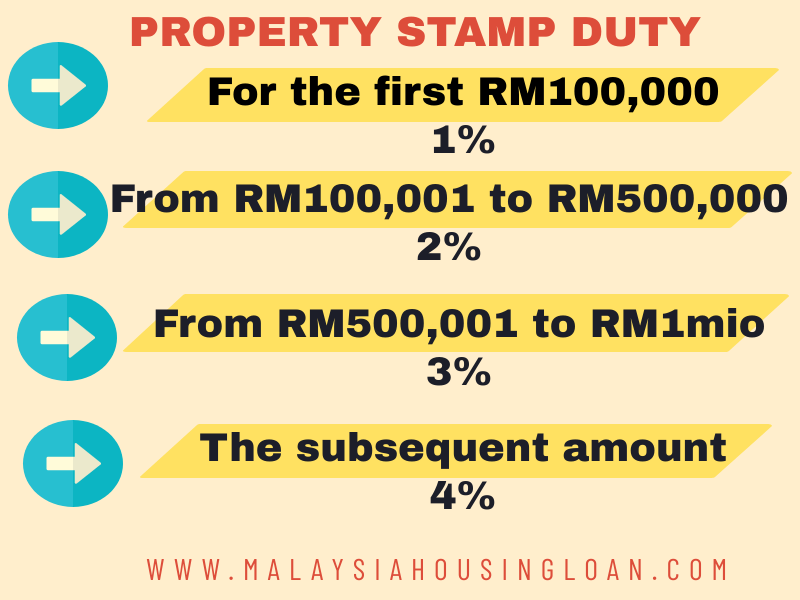

The stamp duty fee for the first RM100000 will be 1000001 RM1000 The stamp duty fee for the remaining amount will be 300000-1000012 RM4000. An inheritance tax is a tax paid by a person who inherits money or property of a person who has died whereas an estate tax is a levy on the estate money and property of a person who has died. How to calculate the new stamp duty rate.

All shares in the capital stocks or funded debts of corporations companies A in Malaysia or elsewhere the stamp duty imposed shall be RM150 for every RM1000 or fractional part of the transaction value of the securities up to a. Calculate the stamp duty you may have to pay on your property using our tool. Stamp Duty Malaysia On A Loan Agreement Its also important to factor in the stamp duty owed for any loan agreement which may be entered into as part of a property purchase.

The 2016 Budget brought changes to the stamp duty land tax SDLT rates payable by purchasers on freehold commercial property and leasehold premium transactions. To calculate the Stamp Duty that may be payable on your planned purchase simply put the purchase price into our SDLT calculator above and click calculate. These changes took effect from 17 March 2016.

Its an annoying expensive requirement that cant be avoided. Since the concession is calculated on a sliding scale the closer the property value is to 600001 the. Liablebuyers are required to pay ABSD on top of the existing Buyers Stamp Duty BSD.

EUPOL COPPS the EU Coordinating Office for Palestinian Police Support mainly through these two sections assists the Palestinian Authority in building its institutions for a future Palestinian state focused on security and justice sector reforms. Varies by state land office and type of property. Learn how to calculate stamp duty from a trusted source with PropertyGuru Finance and use our reliable.

The amount you pay is calculated on a sliding scale generally from 1 to 6 of the purchase price although it can be higher. This Stamp Duty on MOT Calculator Stamp Duty Calculator Malaysia helps to estimate the total amount of Stamp Duty on MOT need to be paid. How To Calculate Stamp Duty In Malaysia.

Legal Fees Stamp Duty Calculation 2022 When Buying A House In Malaysia. Stamp duty in Singapore is a type of tax that all homeowners must be familiar with. The stamp duty for the SPA is only RM10 per copy while the stamp duty for MOT and DOA is calculated according to a fee structure of 1 to 4.

How much is the first home buyer duty concession worth. To know how much down payment lawyer fees and stamp duty needed are so. Stamp duty is a tax on a property transaction that is charged by each state and territory the amounts can and do vary.

The rates are different for first-time buyers. For First RM100000 RM100000 Stamp duty Fee 2. RM100001 To RM300000 RM400000 Total stamp duty must pay is RM500000 So this is the total stamp duty then you can add legal fees disbursement fees valuation fees and other fees to estimate how much the cost of buying the house.

Admin Fee Amount RM1000. Or you can use Tenancy Agreement Stamp Duty Calculator Malaysia to Calculate. Commission - Buying insurance policy through an agent would add another 10 agent commission fee to your premium.

Some Stamp duty is paid fully by buyer and some are shared between buyer and seller and some are fully covered by Developer different situation will be different. Hearst Television participates in various affiliate marketing programs which means we may get paid commissions on editorially chosen products purchased through our links to retailer sites. One time charge by the lenders up to a few hundred ringgit.

Stamp duty Fee 1. ABSD and BSD are computed on the purchase price as stated in the dutiable document or the market value of the property whichever is the higher amount. It is important to note that this is an indicator only your solicitor or tax consultant will advise you as to the actual amount that must be paid on completion.

Like filling your car with fuel before a long trip stamp duty is a necessary evil when you buy a commercial property. Under the reforms SDLT is now payable on the portion of the transaction value which falls within each tax band. Read more about House Purchase in Malaysia.

Sale Purchase Agreement 05 to 10 Loan Agreement 05 and Transfer of Title 10 to 20 Disbursement Fees. Determine the total amount of your annual rental. For some people buying a home is a significant milestone that tops many peoples lifetime to-do lists.

Because stamp duty is tiered see below table you will pay a different stamp duty rate on different portions of the property value. International tax law distinguishes between an estate tax and an inheritance tax citation needed an estate tax is assessed on the assets of the deceased while an inheritance tax is. The Web App below will assist you to calculate Stamp Duty Payable Legal Fee Payable and estimated Admin Fee Payable.

The stamp duty rate will depend on factors such as the value of the property if it is your primary residence and your residency status. All you need is a simple formula which you can refer to here. This means that for a property at a purchase price of RM300000 the stamp duty will be RM5000.

When purchasing non-residential property in England or Wales you are still obliged to pay Stamp Duty Land Tax SDLT - a tax levied on property transactions and payable to Inland Revenue - on non-residential assets above the value of 150000 as it currently stands. Get the latest Home Loan News in Malaysia with iMoney. Normally there are two copies of the tenancy agreement one copy for the landlord and another one for the tenantBoth of the copies have to be stamped by LHDN before the process of moving into a new property occurs.

Use our buy to let Stamp Duty calculator by ticking the Second home or Buy to Let option. This will calculate the new rate of SDLT you will need to pay after 1st April 2016. Its worth noting that this is a separate scheme from the First Home Owner Grant FHOG which is a lump-sum payment whereas the first home buyer duty exemption and concession reduces the amount of stamp duty you pay.

Hearst Television participates in various affiliate marketing programs which means we may get paid commissions on editorially chosen products purchased through our links to retailer sites. This is effected under Palestinian ownership and in accordance with the best European and international standards. Depending on the type of property transaction you will encounter Buyers Stamp Duty BSD Sellers Stamp Duty SSD Additional Buyer Stamp Duty ABSD or stamp duty for rental properties.

Purchasing and hunting for a house can be an exciting and stressful experience.

Exemption For Stamp Duty 2020 Malaysia Housing Loan

Property Stamp Duty Calculation Exemption Property Stamp Duty Malaysia Youtube

Spa Stamp Duty Malaysia And Legal Fees For Property Purchase

How To Calculate Legal Fees Stamp Duty For My Property Purchased Property Malaysia

Calculate Stamp Duty For Your Tenancy Agreement Malaysia Financial Blogger Ideas For Financial Freedom

Stamp Duty Waivers Will Boost Housing Market Says Knight Frank Malaysia The Edge Markets

Latest Stamp Duty Charges 6 Other Costs To Consider Before Buying A House In 2019 Cbd Properties

Stamp Duty Exemption Under I Miliki Announced By The Prime Minister On 15th July 2022 Publication By Hhq Law Firm In Kl Malaysia

Property Law In Malaysia Stamp Duty For Transfer Of Property Chia Lee Associates

Stamp Duty In Malaysia Everything You Need To Know

How Much Does It Cost For Stamp Duty For Tenancy Agreement In Malaysia Property Malaysia

Stamp Duty And Administration Fee 2 Important Aspects For Tenancy Agreement In Malaysia

How To Calculate Stamp Duty For Tenancy Agreement How To Calculate Stamp Duty For Tenancy Agreement Original Video Https Youtu Be 1g9sscemjha Please Subscribe Share Our Youtube Channel For More

Best Calculator For Property Stamp Duty Legal Fees In Malaysia Free

Stamp Duty In Malaysia Everything You Need To Know

Stamp Duty Imposed For Transfer Of Properties In Malaysia By Tyh Co

Comments

Post a Comment